Understanding Order Flow Sequencing in Trading with Sierra Chart

Trading is an intricate dance of buyers and sellers, each with their own strategies and intentions. In a recent video, we delved into the concept of Order Flow Sequencing, a powerful tool for traders looking to gain an edge in the market. we will explain the importance of order flow, and provide insights into how you can use this knowledge to improve your trading.

The Basics of Market Participants

At its core, the market is a two-way auction where buyers and sellers interact. However, it’s not as simple as it seems. There are two main types of traders:

-

Aggressive Traders: These are traders who actively cross the bid-ask spread to execute their orders. For example, an aggressive buyer will buy from a passive seller at the offer price.

-

Passive Traders: These traders place their orders at specific price levels and wait for the market to come to them. Passive buyers work the bid, while passive sellers work the offer.

Understanding the difference between these two types of traders is crucial because it reveals the underlying dynamics of market movement. For a trade to occur, someone must cross the bid-ask line. This is where aggressive traders come into play.

The Role of Time and Sales

The Time and Sales window shows the actual trades happening in the market. It provides valuable information, such as the volume traded at each price level and whether the trade was executed aggressively (buying or selling). However, the challenge is that the market moves incredibly fast, making it difficult to interpret this data in real-time.

Some trades can flash by in milliseconds, making it nearly impossible to keep track of what’s happening without the right tools. This is where footprint charts come into play.

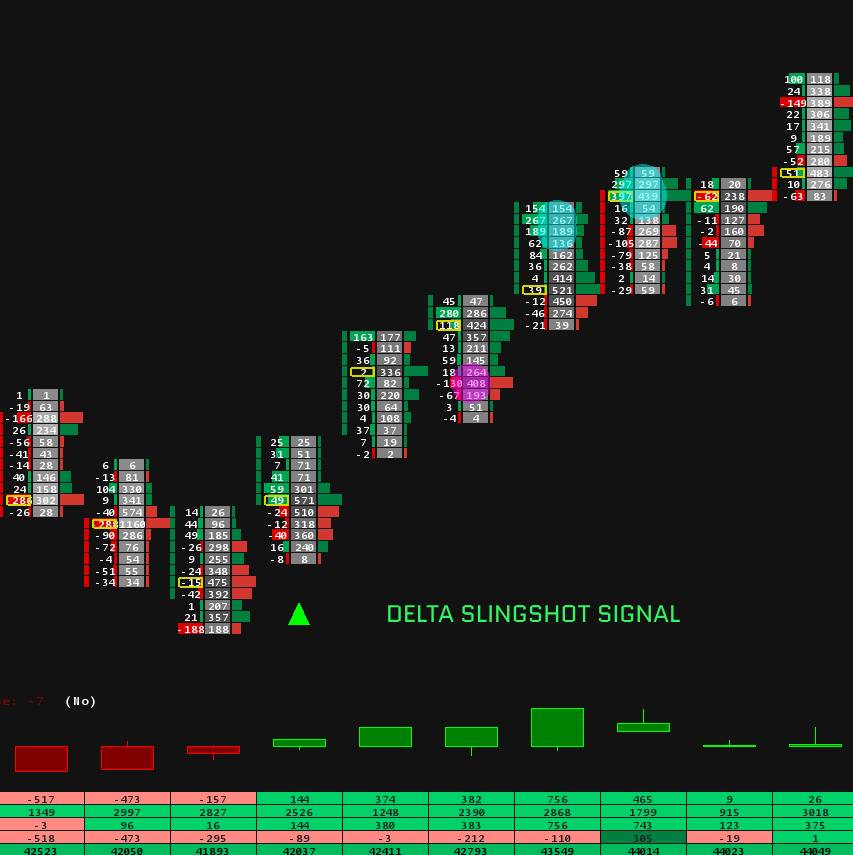

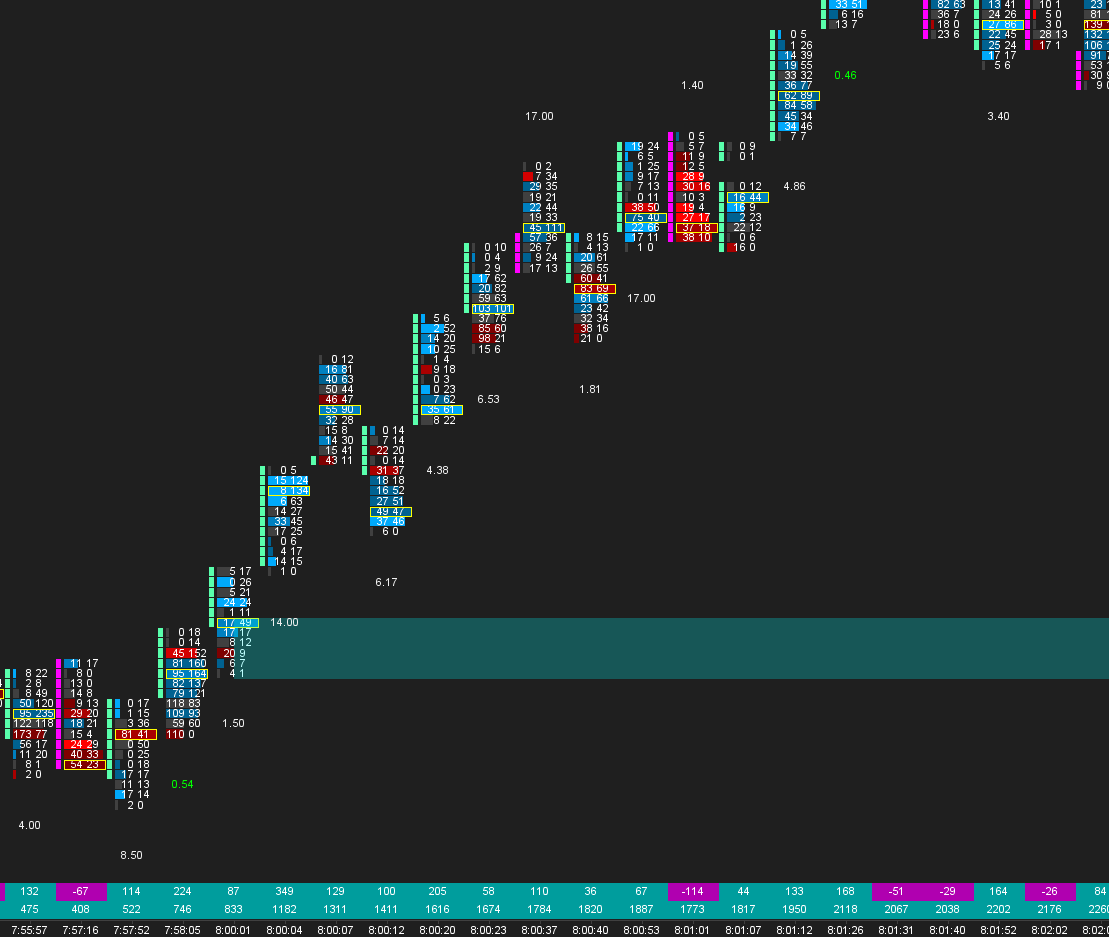

What Are Footprint Charts?

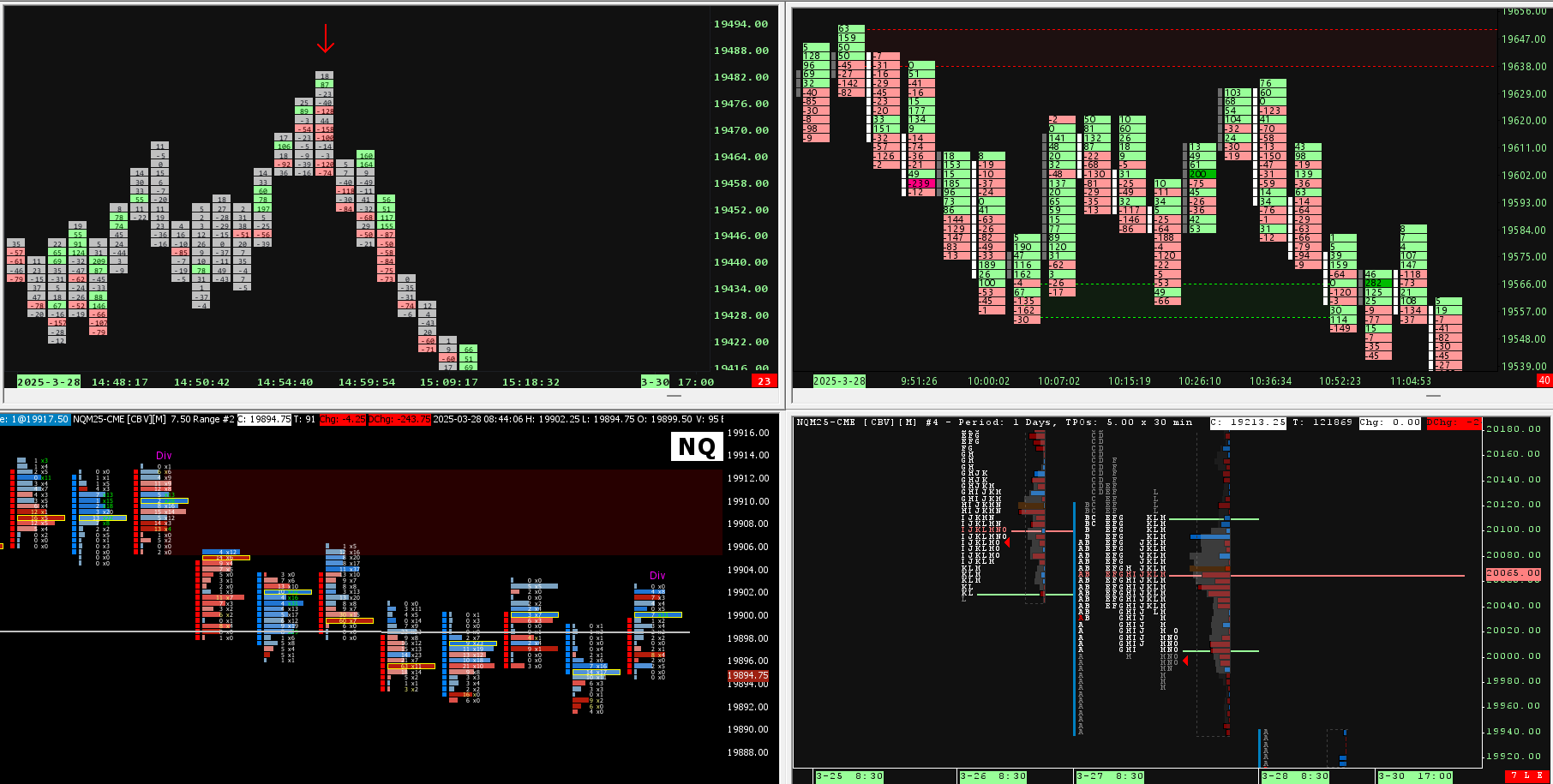

Footprint charts are a visual representation of the market’s order flow. They display the volume traded at each price level and whether the trades were aggressive buys or sells. This allows traders to see where big orders are being executed and identify patterns like sequencing.

-

Bullish Sequencing: Occurs when aggressive buyers take out subsequent higher offers, indicating strong buying pressure.

-

Bearish Sequencing: Happens when aggressive sellers hit subsequent lower bids, signaling strong selling pressure.

By analyzing these sequences, traders can gain insights into market strength or weakness and make more informed decisions.

The Challenge of Resting Liquidity

Resting liquidity refers to the orders sitting in the order book (bids and offers). While it can provide clues about market sentiment, it’s not always reliable. Big orders can be pulled or adjusted as the market moves, making it difficult to predict price action based solely on the order book.

For example, a large sell order might appear to cap the market, but if aggressive buyers step in and absorb that liquidity, the market could continue to rise. This is why it’s essential to focus on actual trades (Time and Sales) rather than just resting orders.

The Power of Order Flow Sequencing

Order flow sequencing is a technique that identifies when the market is absorbing large orders at subsequent price levels. This can signal a potential reversal or continuation of the trend. For instance:

-

If the market is rallying and you see bullish sequencing (aggressive buyers taking out higher offers), it’s a sign of strength.

-

Conversely, if the market is selling off and you see bearish sequencing (aggressive sellers hitting lower bids), it’s a sign of weakness.

In this video below, we demonstrate how the Order Flow Sequencing Indicator for Sierra Chart can help traders identify these patterns automatically. The indicator highlights sequencing zones and provides trade signals, making it easier for traders to spot opportunities without manually analyzing footprint charts.

Key Features of the Order Flow Sequencing Indicator

-

Cluster Size: Determines the minimum number of contracts required to trigger a sequence.

-

Drawing mode: Allows traders extend, highlight the sequenced zones

-

Sound Alerts: Notifies traders when sequencing occurs.

-

Trade Entry Signal: Confirms whether a trade should be taken based on follow-through order flow.

These features help traders filter out noise and focus on high-probability setups.

Practical Applications

Here are a few ways traders can use order flow sequencing in their strategies:

-

Identifying Reversals: Look for sequences where the market absorbs large orders and reverses direction.

-

Confirming Breakouts: Use sequencing to confirm whether a breakout is likely to continue or reverse.

-

Setting Stops: Use sequencing zones as reference points for stop-loss levels.

Conclusion

Order flow sequencing is a powerful tool for traders who want to understand the underlying dynamics of the market. By analyzing aggressive and passive trading activity, you can gain valuable insights into market strength, weakness, and potential reversals. Tools like the Order Flow Sequencing Indicator make it easier to identify these patterns and execute trades with confidence.

If you’re interested in learning more about order flow sequencing or trying out the indicator, check out the link in the video description. Happy trading!